Unlock deeper market insights with pro-grade indicators

Markets move in cycles and structures that repeat across timeframes. To navigate them effectively, traders need tools that provide both structural clarity and reliable positioning. With that principle in mind, we have crafted Williams Fractal Pro & DWIN Reversal.

For this reservation event, only 50 copies will be released to the fastest. Once they’re gone, the price will rise, don’t miss your chance.

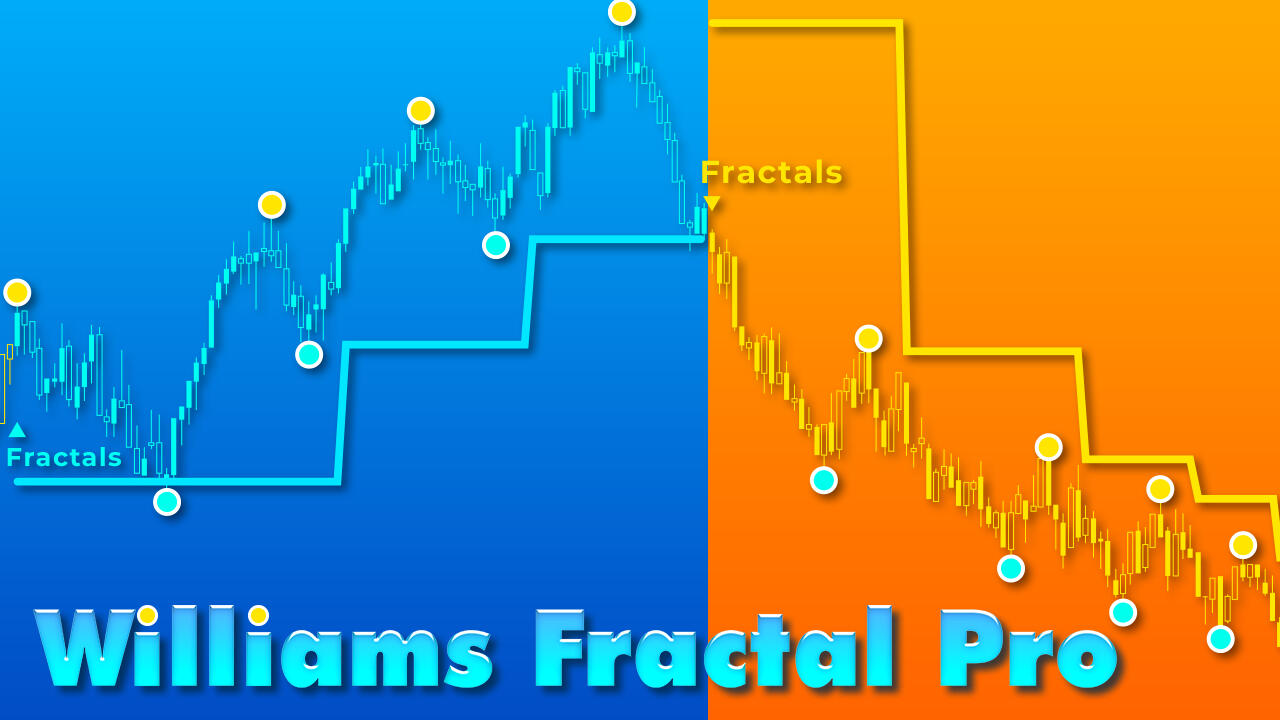

Williams Fractal Pro: Transform swing points to clear trend maps for catching breakout

Bill Williams – the pioneer behind the Williams indicator series – highlighted that markets operate on repeating fractal structures, with Swing Highs and Swing Lows leaving clear traces of trend development.Williams Fractals Pro is built upon this foundation.It transforms complex swing points into a clear framework of market structure, helping traders read price action with greater accuracy and discipline.

Multi-Level Trend Identification

Helps you identify trends and their levels through Swing Points in a simple, highly reliable way.It's suitable for many trading styles and methodologies.

Powerful Breakout Signals

Confirms structural breakouts using closing prices, providing clear and reliable breakout signals – reducing noise and avoiding emotional entries.

Smart Trailing Stops

Offers dynamic trailing stops based on peaks/troughs at multiple trend levels – both protecting profits and staying aligned with market trends.

Multi-Level Trend Identification

Confirms structural breakouts using closing prices, providing clear and reliable breakout signals – reducing noise and avoiding emotional entries.

Multi-Level Trend Identification

Confirms structural breakouts using closing prices, providing clear and reliable breakout signals – reducing noise and avoiding emotional entries.

DWIN Reversal: Instantly revealing whether price is near the top or bottom of its cycle

Whereas many oscillators attempt to measure strength (RSI) or momentum (MACD), DWIN Reversal provides a different perspective: it shows whether price is currently positioned near the top or the bottom of its cycle.With an inverted scale (-100 → 0), DWIN Reversal emphasizes extreme conditions:

• Values near 0 indicate overheated markets – conditions where risk of exhaustion or reversal is high.

• Values near -100 indicate pessimism – conditions where recovery or reversal may emerge.

Instant Market Positioning

Shows clearly whether price is near the top or bottom of its cycle, giving traders immediate context without guesswork.

Powerful Breakout Signals

Highlights extreme conditions (near 0 = overheated, near -100 = oversold), warning of potential reversals at critical points.

Avoid FOMO Traps

Helps prevent buying at the top or selling at the bottom by clearly showing when price is stretched.

Smart Trailing Stops

Uses a direct comparison of closing price to amplitude – no smoothing, no unnecessary complexity delivering fast and reliable signals.

Consistent Decision Support

Unlike momentum indicators that leave traders uncertain, DWIN Reversal consistently signals:

• High threshold → look for sell opportunities

• Low threshold → look for buy opportunities

The total value of these 2 new indicators will be $750 , but you can save more today...

Williams Fractal Pro

Original price: $396

$218

DWIN Reversal

Original price: $396

$196

Powerful bundle

Original price: $792

(Include both indicators)

$376

Extra DWIN bundle for you: DWIN Trend + DWIN Reversal

Both DWIN Reversal and DWIN Trend are built on the Williams %R oscillator but serve different purposes:

• DWIN Reversal highlights cycle extremes, warning when price approaches exhaustion near the top or bottom.

• DWIN Trend tracks trend phases – strong/weak uptrends and downtrends – while providing valuable resuming signals for trend followers.Together, they create a balanced approach:

• Reversal alerts traders to potential turning points.

• Trend confirms direction and distinguishes phases.

• Combined, they improve selectivity, timing, and discipline by uniting cycle awareness with structured trend analysis.